Is the life insurance you’re getting through your employer enough to take care of your family? And are you paying too much for that coverage? A healthy 50-year-old male could save nearly 80% on premiums in the first year alone by switching from an employer-provided term life insurance policy to an individual one, according to the National Association of Financial Planners. Young, healthy employees might also be better off with individual coverage, since they can lock in low rates for decades.

But many companies pay for some amount of life insurance for their workers; they also allow workers to purchase more coverage for themselves and their spouses at a low cost and with no medical exam. As a result, many families obtain all of their life insurance through an employer. If you make $75,000 per year, your employer might provide $75,000 or $150,000 in coverage at little or no out-of-pocket cost to you, and the premiums will come straight out of your paycheck. This way, you’ll never miss the money or worry about paying the bill. And even if you’ve had less-than-perfect health, you’ll qualify for just as much coverage as your co-workers. That all sounds enticing, but there are several potential problems with obtaining life insurance through work.

Problem 1: Your Employer May Not Offer Enough Life Insurance

While basic employer-provided life insurance is low-cost or free, and you may be able to buy additional coverage at low rates, your policy’s face value still may not be high enough. If your premature death would be a financial burden to your spouse and/or children, you probably need coverage worth five to eight times your annual salary. Some experts even recommend getting coverage worth 10 to 12 times your annual salary. PKIG can help determine how much you need based on your goals.

Another shortcoming? Salary doesn’t take into account bonuses, commissions, other sources of income, and the value of other benefits such as medical insurance and retirement contributions.

Your employer’s group life insurance might be sufficient if you’re single or if you have a spouse who isn’t dependent on your income to cover household expenses and you don’t have children. But if you’re in this situation, you might not need life insurance at all.

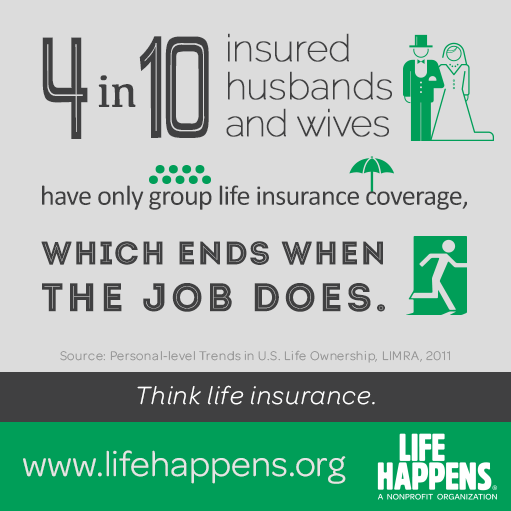

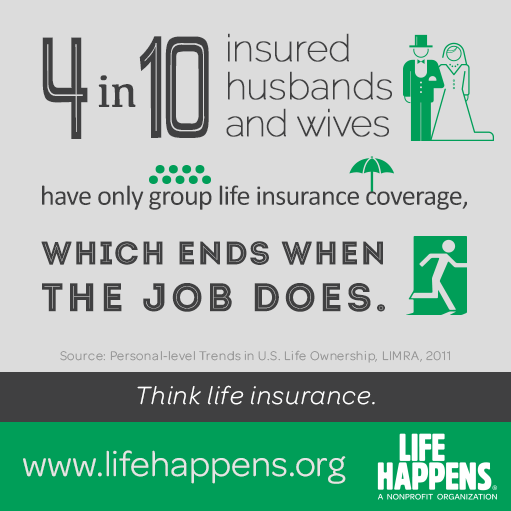

Problem 2: You’ll Lose Your Coverage If Your Job Situation Changes

As with health insurance, you don’t want gaps in your life insurance coverage because you never know when you might need it. Most workers who get coverage through work don’t know where their life insurance will come from if they change jobs, are laid off, their employer goes out of business or they switch from full-time to part-time status. You usually won’t be able to keep your policy in these scenarios. Lack of portability can be a problem if you aren’t going directly to another job with similar coverage and aren’t healthy enough to qualify for an individual policy. Some policies do allow you to convert your group policy to an individual one, but it will likely become much more expensive. If you’re losing your coverage because you were laid off, the premiums might be unaffordable.

Problem 3: Coverage Gets Tricky If Your Health Declines

Another problem arises if you’re leaving your job because of a health problem. If a medical condition forces you to leave your job, it’s unlikely that you would be able to qualify for life insurance at that time. Needless to say, that’s the time your family would need the coverage most.

Even if your health problems aren’t significant enough to stop you from working, they might limit your employment options if you only have life insurance through work.

Problem 4: Your Plan Doesn’t Provide Enough Coverage for Your Spouse

While your employer’s benefits package probably provides health insurance for your spouse, it won’t always provide life insurance for him or her. If it does, the coverage may be minimal—$100,000 is a common amount, and that doesn’t go far when you lose your husband or wife unexpectedly.

Couples often assume the family will only suffer economic hardship if the primary breadwinner dies and many workers fail to adequately insure their spouses. The death of a non-working or lower-earning spouse can certainly impact their partner’s income. You probably aren’t going back to work on Monday if you lose your spouse over the weekend. How much paid time off do you have to cover an extended leave? Plus, you must now pick up the slack with day care or carpooling – hours can be cut back – there won’t be enough time to properly grieve and survivors are often depressed which lowers productivity.

Problem 5: Employer-Provided Life Insurance May Not Be Your Cheapest Option

Even if you can get all the life insurance you need for both you and your spouse through your employer, it’s a good idea to shop around to see if your employer’s supplemental insurance really offers the best value for the money. You’re more likely to find a better rate elsewhere the younger and healthier you are. Also, unlike the guaranteed level-premium life insurance you can purchase individually, which costs you the same amount every year for as long as you have the policy, the policy provided by your employer tends to get more expensive as you age.

Employer provided coverage tends to increase in price after age 35 and typically increases every year or five years. Once you reach age 50 the policy can often become much more expensive and usually unaffordable closer to retirement age.

The Solution

While there’s no reason not to take advantage of any free or inexpensive insurance your employer offers, it probably shouldn’t be your only source of life insurance, nor should most people rely heavily on the supplemental life insurance they can get through work. The solution to each of the problems described above is to purchase some or all of your life insurance directly through an individual term policy. You might need to purchase as much as 80% of your life insurance on your own to have enough and to make sure you’re covered at all times and under all circumstances.

If you don’t think you qualify for individual life insurance, it’s important to actually find out. Underwriting standards have changed considerably over the past ten years or so. Also, if you work with an Independent Agency like PKIG your chances of approval will be dramatically higher. Captive insurers such as State Farm or Allstate typically have much stricter underwriting standards which lead to higher premiums and more frequent declinations on average. The most affordable solution is to buy the most insurance you can afford at the youngest age, since, as you age, the chance of acquiring an illness goes up, and with illness comes more expensive premiums, if you can qualify at all.

The Bottom Line

You need enough life insurance to cover all your debts and support your dependents. “Enough” includes paying off your credit cards, car loans and mortgage, paying for your children’s education, and making sure your spouse will have the financial means to take care of him or herself and your children. In a time of grief, the last thing you want is to leave your loved ones with another major life upheaval such as having to change jobs or schools because of financial strain, so take a close look at whether the life insurance you’re getting through work is the best way to provide for your loved ones.

Get instant quotes on top-rated life insurance coverage here in less than 30 seconds or call (248) 682-7445 for more information today.